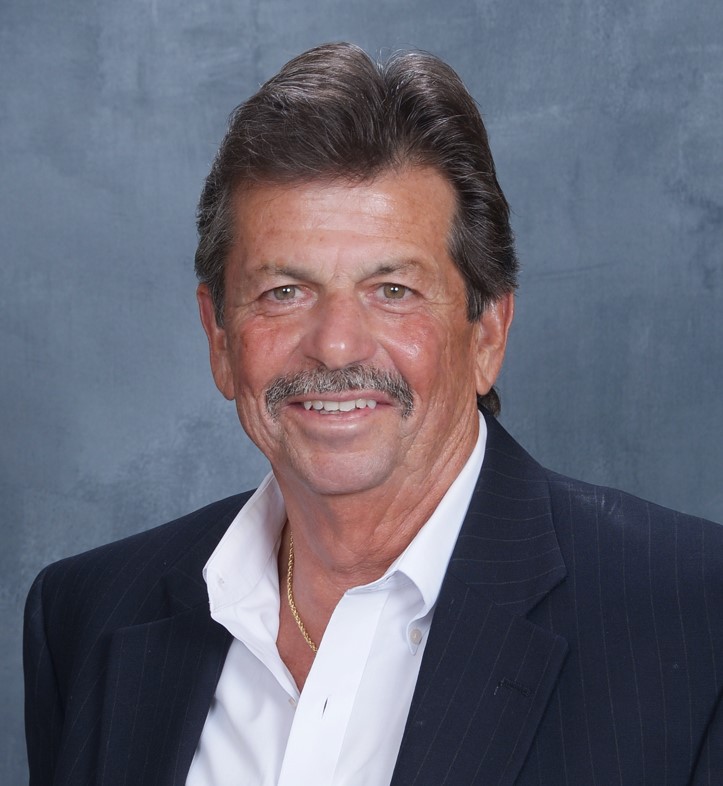

Joe Edgeworth

The Edgeworth Insurance Group

The Misfit Annuity

Financial Missteps that Fail Client Needs

As financial advisors, we provide our clients with the best advice tailored to their unique needs, goals, and circumstances. Annuities, a prominent element in retirement planning, are often seen as a pillar of stable and predictable income. However, not all annuities are created equal, and the inappropriate recommendation of an annuity product can lead to a significant financial misstep. When asked about my least favorite annuity, it isn't a specific product but an annuity that a financial advisor recommends that fails to align with the client's situation.

When it comes to annuities, one size does not fit all. A vast array of annuity products exist, each with its terms, benefits, and risks. Some annuities offer fixed rates of return, while others tie investment gains to the performance of a particular index or group of securities. Still, others provide a guaranteed income for life, with the trade-off being limited access to the principal.

Imagine a financial advisor recommending an annuity focused on investment and growth with fees and surrender charges to a retiree in her late 70s. This individual requires a steady income, minimal risk, and no desire or need for aggressive growth. The product must meet the client's needs or align with her risk tolerance, creating a potentially detrimental mismatch. This scenario encapsulates the "least favorite annuity" I am referring to.

Financial advisors must adhere to the principle of suitability, ensuring that any recommended financial products align with the client's objectives, risk tolerance, and financial situation. Unfortunately, a lack of understanding, incomplete evaluation of client needs, or even, at times, potential conflicts of interest may lead to the recommendation of annuities that are not the best fit.

For instance, if a financial advisor is recommending annuities based on commissions, it might suggest a conflict of interest. It becomes even more problematic if the recommended annuity doesn't provide the most efficient or beneficial way to meet the client's needs. The line between prudent advising and self-serving salesmanship becomes blurred in such cases.

Avoiding the 'least favorite annuity' scenario requires transparency, due diligence, and communication between the financial advisor and the client. Advisors must conduct a thorough needs analysis to understand the client's financial goals, risk tolerance, and investment timeline. On the other hand, clients need to be forthcoming about their financial situation and objectives and ask questions about recommended products.

The key is trust and transparency. Financial transparency can increase trust, accountability, and informed decision-making. It allows the prospect to assess financial health, performance, and risk exposure.

Here are some tips for working with a financial advisor to choose the right annuity for you:

- Get multiple quotes from different insurance companies.

- Compare the features and benefits of each annuity.

- Make sure you understand the fees associated with each annuity.

- Consider your individual needs and goals when making a decision.

When matched with the proper client needs, annuities can play a valuable role in a retirement plan, providing guaranteed income, tax advantages, and protection against longevity risk.

To summarize, my least favorite annuity is not a product per se but an approach that neglects the critical principle of suitability, recommending annuities that fail to align with a client's needs and circumstances. As a financial advisor, the most significant aspect is to be a fiduciary, which includes understanding client needs, thoroughly researching potential investments, and recommending solutions that genuinely serve the client's best interests. In the realm of annuities, as with all financial planning, the mantra should always be the right product, for the right client, at the right time and for the right reason.

- Annuities may offer significant benefits when appropriately aligned with a client's financial goals and risk tolerance. Still, a mismatch between the annuity product and the client's needs may result in detrimental financial outcomes.

- The principle of suitability is critical in financial advising, and failing to uphold it, possibly due to conflicts of interest or insufficient understanding of the client's circumstances, can lead to the recommendation of unfit annuity products.

- Avoiding such misfit annuities requires transparency, thorough needs analysis, and effective communication between the financial advisor and the client, ensuring the right financial product is recommended for the right client at the right time.

Many people have learned about the power of using the Safe Money approach to reduce volatility. Our Safe Money Guide is in its 20th edition and is available for free.

It is an Instant Download. Here is a link to download our guide:

Joe Edgeworth

The Edgeworth Insurance Group

2715 Spring Valley Rd.

Lancaster, Pennsylvania 17601

joe.edgeworth@retirevillage.com

(800) 824-8609

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!