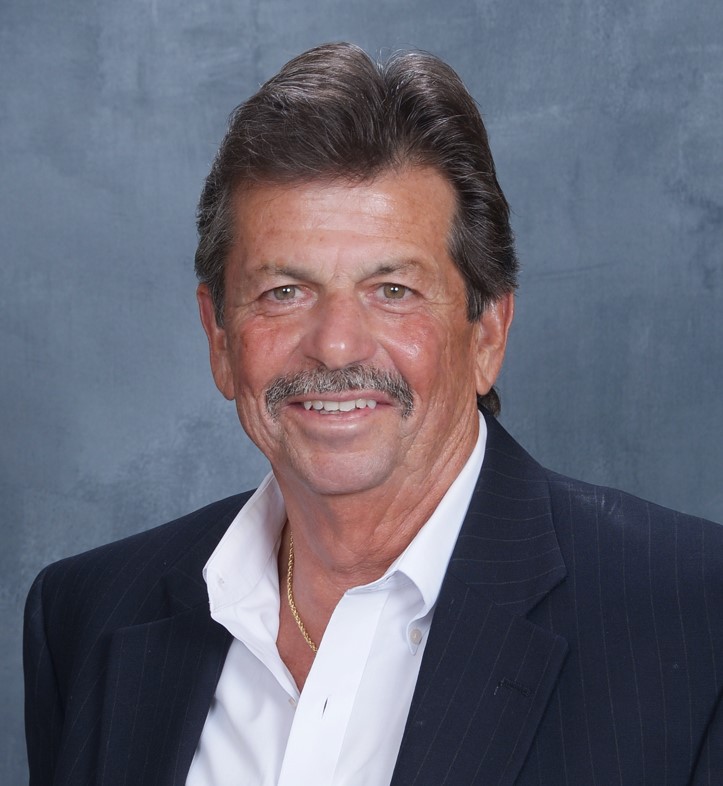

Joe Edgeworth

The Edgeworth Insurance Group

The Golden Years Might Become Scary

When the Social Security Administration announced that for 2016, 2017, 2018, there would be NO “cost of living adjustment” (COLA) to retirement payments, many considered inflation was under control. Now an announcement of COLA Increase for 2022 of 5.90%

The reason for no COLA is simple, and Congress sets the COLA based on the Consumer Price Index (CPI) performance.

The CPI failed to grow enough to trigger the COLA for those of us on social security. In the past 40 years, this has only happened three times.

The CPI failed to grow enough to trigger the COLA for those of us on social security. In the past 40 years, this has only happened three times.

In 2019, the COLA increase was 2.8%, and for 2020 a forecast of 1.8%, 2022 has an increase in COLA of 5.9%. Why?

In one sense, this is good; it means that inflation has been low, and the cost of daily living is still affordable. But the reality is the things we need for much of our daily life, food, and energy, are not included in the calculation of Social Security COLA. Both of those categories have skyrocketed. How can the CPI still say there is no actual cost in living expenses? The answer is simple: during the Clinton Administration, food was removed from the calculation for the CPI Index.

The CPI does not track food or energy expenses; they are both exempted categories from the CPI. The cost of going to your doctor is going to cost you more for insurance and out of pocket.

As we all know, the cost of medical care expenses is also skyrocketing. NO, it is not; last year (2020), the overall cost of medical care expense increased only 5.8%. And yet, with no COLA, the cost for insurance ourselves increased more than the actual price for medical services. Ask this question: Why are premiums for Medicare Part B higher than the actual overall medical costs increase? Will the 2022 COLA cover the cost of Medicare Part B in 2022? The increase in Part B is scheduled to go up on average by 14.5%. ($21.50 per month) How does that affect the COLA Social Security adjustment?

According to a recent report from the Center for Retirement Research at Boston College, the difference in insurance and actual costs is a significant difference and may be a financial burden for many retirees.

Retirees on a fixed income may find it more and more challenging to maintain a standard of living beyond the poverty level.

Here is a link to the report from the Center for Retirement Research: http://crr.bc.edu/briefs/no-social-security-cola-causes-medicare-flap/

Joe Edgeworth

The Edgeworth Insurance Group

2715 Spring Valley Rd.

Lancaster, Pennsylvania 17601

joe.edgeworth@retirevillage.com

(800) 824-8609

Looking For Answers?

Download our Safe Money Guide and learn more about safe retirement options that can help you achieve your retirement goals safely - FREE!